The Best 4 DeFi Staking and Rewards Platforms

DeFi (Decentralized Finance) provides peer-to-peer financial services without directing to the centralized system, which became a crucial alternative to the traditional financial system nowadays. Apart from using DeFi for processing authorized transactions, the concept of DeFi staking has also become a trend. Simply put, DeFi staking is the idea of earning rewards by holding a certain amount of crypto tokens. With the help of advanced technology, such staking can be done through some top DeFi staking platforms in the market.

A variety of DeFi staking platforms have been introduced for DeFi staking in the market. Most of these staking platforms are helpful tools to gain additional rewards from your holdings by using the reward programs. In the following, 4 top DeFi staking platforms will be introduced. If you are interested in DeFi staking, it is not a bad idea to start familiarizing yourself with these staking tools and getting your hands on the project you hold.

Read More: Introduction to DeFi Staking: What is it and How does it work?

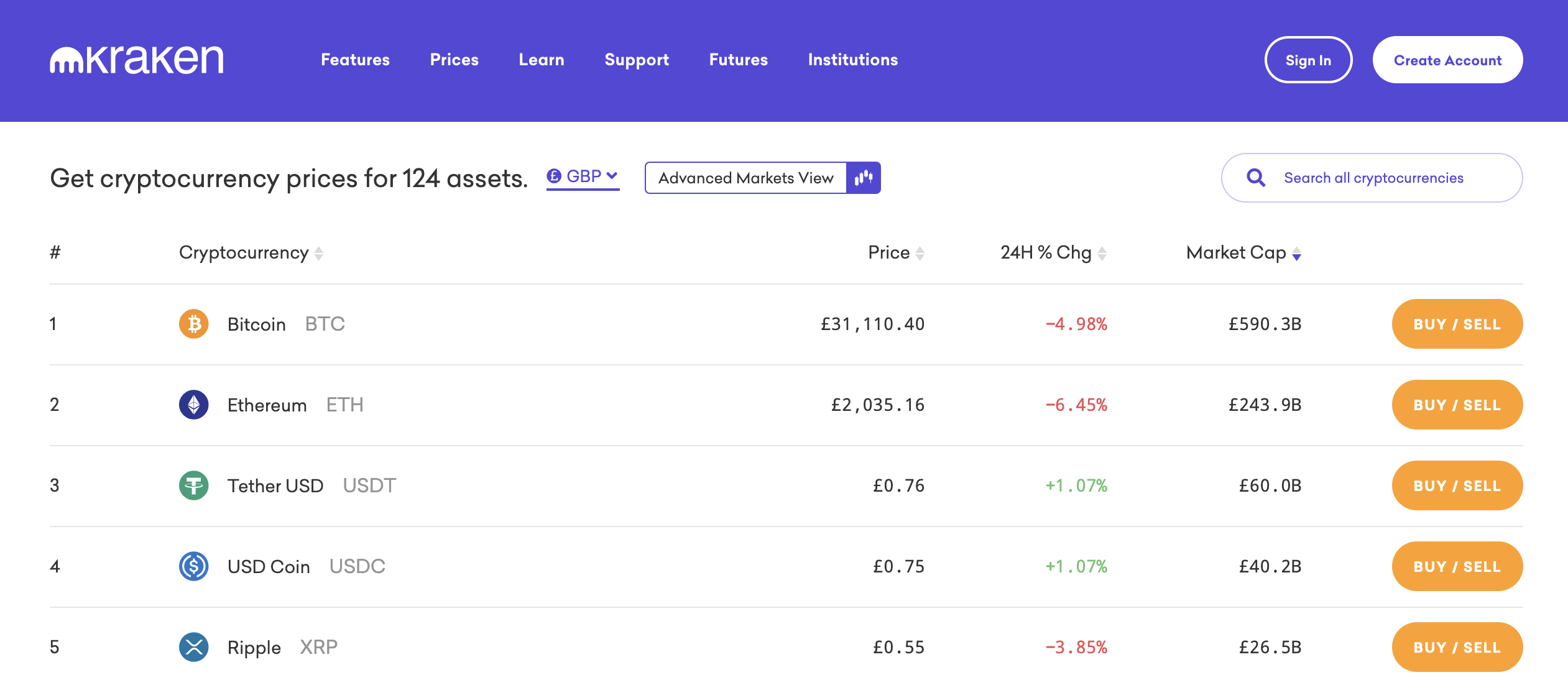

Kraken – Well-known cryptocurrency exchange and top DeFi staking platform

Kraken is known as a cryptocurrency trading platform, but it is also an exchange for staking and rewards. Kraken’s staking assets and rewards support up to 10 cryptocurrencies, including Ethereum (ETH 2), Cardano (ADA), Polkadot (POT), Cosmos (ATOM), Flow (FLOW) etc. It offers different yearly rewards of up to 20%, depending on the token. For example, 4-6% yearly wards can be earned by staking Cardano, 12% from Polkadot, 23% from Kava (KAVA) and more. Kraken is especially suitable for staking beginners not only because it is a reliable exchange platform, but also there’s no minimum time you need to stake your cryptocurrency to earn rewards. Rewards will be distributed once or twice a week and technically, the longer you stake, the more potential rewards you can gain.

Gemini – Collect your daily staking rewards

Gemini is another well-known crypto exchange platform like Kraken which also offers staking rewards through the services. Yet, compared to Kraken, it has more token options for staking as it allows investors to stake up to 43 cryptocurrencies. Most tokens for which rewards are available are reviewed by NerdWallet, an American personal finance company, ensuring your assets are in good hands. Another point that differs from Kraken is that rewards will be distributed per day. There is a downside that it takes up to five business days to collect the return requested, although users can request a return anytime.

Balancer – The Automated portfolio manager and trading platform

The two above exchanges are the centralized exchange where investors can do their stakings. Yet, Balancer is a decentralized exchange, which not only allows investors to get the best cryptocurrency price and free trades but also allows them to stake into the Balancer pool. It provides large liquidity pools where massive staking rewards are available for liquidity providers, with around 20M GIV of staking rewards. Once you have added your tokens to the platform, you can directly stake them for bonus rewards.

Uniswap – An automated fully decentralized exchange for staking

Uniswap is a decentralized exchange based on the Ethereum network. The exchange allows users to get rewards and earn passive income by a staking process. To start staking tokens on Uniswap, users need to connect and use a decentralized wallet like Metamask or WalletConnect, then they have to fund the wallet with ETH, in order to pay transaction fees on the Uniswap platform, and also for staking.

Every investment contains a certain level of risk. You should always evaluate the associated risk level before investing in any of the investment options!

Subscribe For The Latest

Analysis Report